How Taxable Brokerage Accounts Boost Financial Flexibility

why a taxable brokerage account matters for nonprofit professionals and charitable-minded individuals

If you work as a nonprofit professional, an educator or administrator, or you a charitable-minded individual, you probably have, or had, access to a 401(k) or 403(b) retirement plan. These retirement plans are great for building the necessary funds for retirement… within reason. One of the biggest financial flaws that I see nonprofit professionals and others make is that their entire nest egg is invested within a 401(k) or 403(b) retirement plan. An underrated aspect of investing and tax planning is optionality - the ability to draw from different investment accounts in the future. There’s not a better solution to providing you with greater optionality than a taxable brokerage account.

In today’s post, I’ll discuss how this account can be of value for mission-driven professionals like you. First, I will address how brokerage accounts are different than retirement accounts. Next, you will read about some real-life case studies of how taxable brokerage accounts helped fund a home improvement for a nonprofit executive director and how an appreciated stock fund helped a retired couple donate to their favorite charity. We will end by answering how you can open a brokerage account in 5 steps and review some frequently asked questions.

the differences between a brokerage account and a 403(b)

When Do I Pay Taxes on a Withdrawal from a Brokerage Account and a 403(b)?

With a brokerage account, the withdrawal may or may not be taxed depending on how much of the withdrawal is from investment growth. I’ve included a Case Study within this blog to help demonstrate the taxability of brokerage account withdrawals.

A 403(b) withdrawal is either entirely taxable or tax-free. If your withdrawal is associated with pre-tax contributions, then you will pay taxes on the withdrawal. Conversely, if your withdrawal is associated with after-tax (Roth) contributions, then you will not pay income tax on the withdrawal.

The IRS is going to tax your money either in the year you earned it, or the year you withdraw it from an investment account.

A pre-tax contribution means you did not pay income tax in the year the contribution was made into your 403(b). So, the only other time to tax that money is when you ultimately withdraw it from your 403(b).

With a after-tax (Roth) 403(b) contribution, you contributed the money AFTER paying income tax in the year that money was earned. The IRS is not going to tax that money twice, so you get to withdraw the funds tax-free in retirement.

Income Tax Rates

Ordinary income is taxed at one of seven tax rates. NerdWallet has a helpful chart that you can access here

Long-term capital gains and qualified dividends are taxed at more favorable rates. Instead of seven tax brackets, long-term capital gain is taxed at either 0%, 15%, or 20%. Most people will fall in the 15% bracket. You can access those tax brackets here

Contribution Limits

Investment Options

403(b) retirement plans are employer-retirement plans managed by a plan sponsor. The plan sponsor limits your selection of investment funds to make it easier to manage employee accounts.

When You Can Withdraw Funds

Can I withdraw from a brokerage account at any age? YES! Brokerage accounts provide maximum financial flexibility because you do not have to worry about any IRS penalties for taking a withdrawal before a certain age.

With 403(b) plans, you generally have to wait until you turn 59 1/2 before being able to withdraw funds without a penalty. The IRS deems these plans as retirement plans, and have strict withdrawal rules to ensure funds are used for retirement.

key strategies: tax-loss harvesting and charitable giving of appreciated investments

Tax-Loss Harvesting

What is tax-loss harvesting?

This strategy involves the strategic selling of investments for less than the original investment, thereby generating capital losses.

Why what are the benefits of capital losses?

Capital losses can help you in two different situations:

First, they can be used to offset capital gains, thereby reducing your taxable income. Consider the example above, where you sold XYZ stock to generate a $7,500 loss. Those capital losses are “netted” against the gains from selling ABC stock. The result is that you report $7,500 of capital gains on your taxes, instead of the $15,000 from selling ABC stock.

The other benefit of capital losses is that they can offset up to $3,000 of ordinary (non-capital gain) income. Let’s say you only sold XYZ stock, for a capital loss of $7,500. You can use those capital losses to offset ordinary income because there are no capital gains to offset the capital losses. However, the IRS limits the use of capital losses to offset non-capital gain income to $3,000. In this example, the unallowed losses of $4,500 carry forward to future tax years.

What if I want to reinvest my money in the investment that I sold for a loss?

The IRS has a rule called the wash sale rule, which states that you have to wait 31 days to purchase the same investment, or a substantially identical investment. If you don’t wait the 31 days, then you cannot use the capital loss from the earlier sale. For an example, you can read this case study from the IRS.

Charitable Giving of Appreciated Investments

How does donating appreciated investments work?

For charitable-minded individuals, a taxable brokerage account provides the funding to make a huge impact on your favorite charities, while also saving you on taxes. The strategy of donating appreciated investments requires a contribution to a Donor-Advised Fund, which you can learn more about from a previous blog post of mine. In short, the process is as follows:

Look for investments within your brokerage account that have the largest gains.

Donate (contribute) shares of that investment to your Donor-Advised Fund. DO NOT SELL THE INVESTMENT AND THEN PROCEED TO DONATE THE CASH.

Make donations (grants) to charities or invest the funds and donate to charities in the future.

What is the tax benefit to donating appreciated stock?

Contributions to DAFs are an itemized deduction in the year of the contribution. Generally, you claim a tax deduction for the fair market value (FMV) of the investment if you held that investment for longer than one year.

The benefit of donating appreciated investments is that you avoid any future capital gains that you would otherwise incur from selling that investment while it was held in your brokerage account.

how to setup a brokerage account in 5 steps

Step 1: Pick a custodian

A custodian is an entity responsible for the safekeeping of your investments and assets. For example, companies like Vanguard, Fidelity, and Charles Schwab are all custodians. Your investment accounts are “housed” here and these companies assume the responsibility of making sure your accounts are protected against fraud and theft.

Step 2: Open the Account

Brokerage accounts can be owned by an individual, jointly, or a trust, so you will want to be prepared with the appropriate information depending on the type of ownership. Here are account opening links to Vanguard, Fidelity, and Charles Schwab.

Step 3: Link a Bank Account

I highly recommend my clients to connect a bank account to their brokerage account. Doing so allows for money to be pushed (deposited) from the bank account into the brokerage or pulled (withdrawn) from the brokerage account to the bank account.

Usually, you will add bank information as part of the account opening process. If you don’t, you will need to add a bank account after the account is opened.

Step 4: Fund the Account

You can begin to fund your brokerage account once you’ve established a link between your brokerage account and your bank account. Because there is no annual contribution limit, you are free to contribute as much as you’d like.

Step 5: Invest Your Contributions

This is everyone’s favorite part! Okay, maybe not, as a brokerage account allows you to invest in every type of investment practically and that can be a tad overwhelming. Nonetheless, once you’ve determined how you’d like to invest your contributions you will want to place the trades to purchase your desired investments.

case study #1: a nonprofit executive director funds a $100,000 home improvement project

An executive director in their 40s and their spouse wanted to complete a partial home remodel. They were targeting a budget of $100,000, but was unsure about how to fund the project.

One idea was to take out a Home Equity Line of Credit (HELOC) but interest rates were above 8%, which made this option quite unattractive.

Then, we looked at their brokerage account and determined that we could sell $100,000 of investments over the span of two years (late-2025 and early-2026) without torpedoing their taxes.

The Strategy:

This fall (2025), we will sell $50,000 of a mutual fund and generate $20,000 of long-term capital gains.

In January 2026, we will sell another $50,000 of the same mutual fund. We project a similar long-term capital gain of $20,000.

The funds will “sit” in their high-yield savings account until the expenses are due.

The Tax Impact:

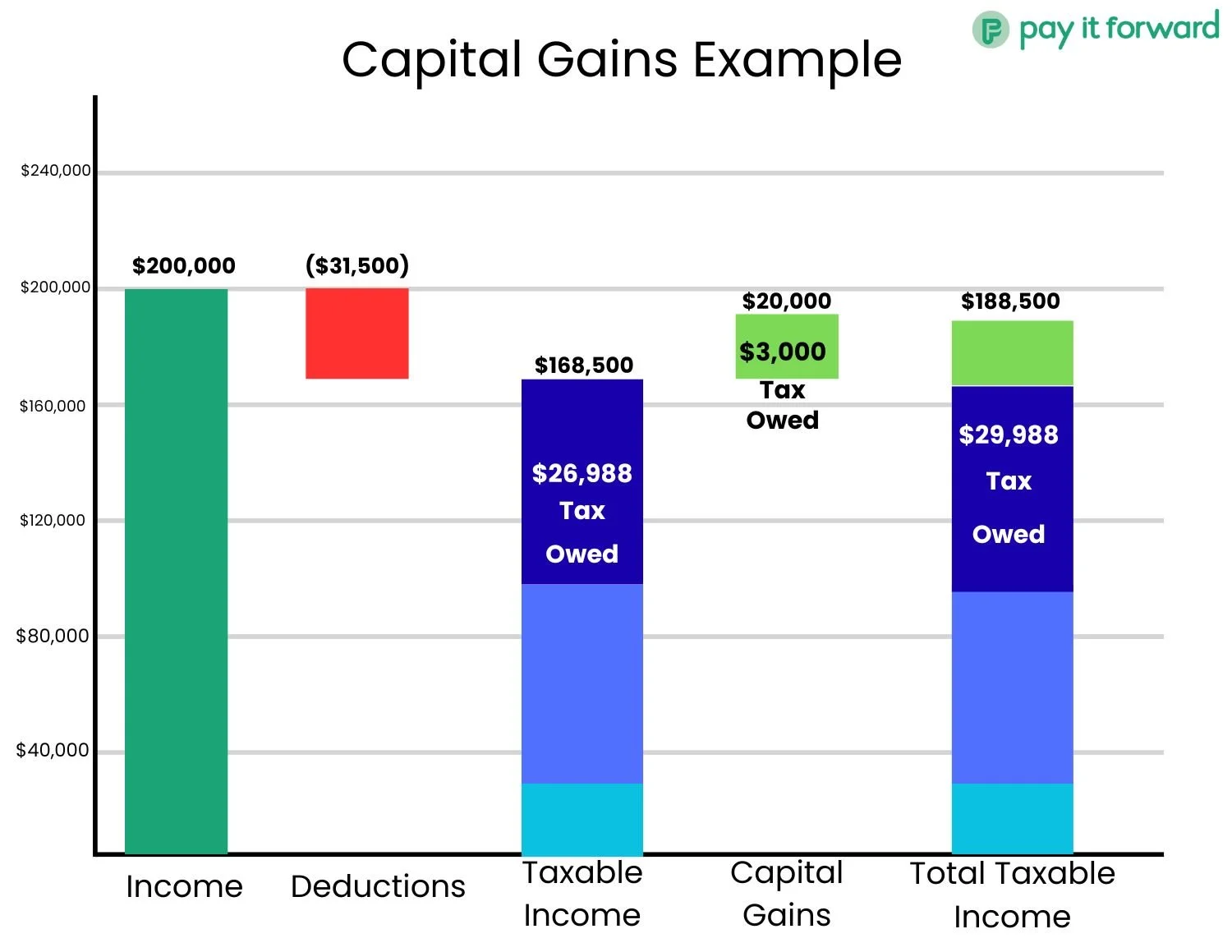

From the Capital Gains graphic, you will notice that the non-capital gain taxable income is calculated before you add any capital gain income. In this sense, your capital gain income is “stacked” on top of non-capital gain income.

In the case of the nonprofit executive director and their spouse, the $50,000 sale in their brokerage account generated $3,000 in federal taxes. Why?

$30,000 of the sale is a return of their initial investment, which is called your basis. The portion of a sale that is deemed basis is non-taxable income.

They are in the 15% long-term capital gain tax bracket. So, 15% of $20,000 in gain equals $3,000.

Key Takeaways:

The beauty of a taxable brokerage account is the ability to generate long-term capital gain income, which is more favorable than ordinary income.

This couple was able to turn a $60,000 investment into a $100,000 withdrawal, and only increased their taxes by $6,000 over two years.

case study #2: a charitable-minded retired couple maximizes their tax savings while funding future charitable donations

A retired couple in their early-70s likes to annually give $10,000 - $15,000 per year to various charities. They wanted to discuss the most tax optimal way to meet their giving goals.

This particular couple had built up quite a large balance in their taxable brokerage account. In addition, we completed a large Roth Conversion earlier in the year, so we wanted to pursue a tax strategy that would reduce the couple’s 2025 taxable income.

We settled on a strategy known as “chunking”, where you frontload years of charitable contributions and make a large charitable contribution, thereby increasing your deductions in the same year your income is large.

The Strategy:

Contribute $60,000 of an appreciated stock fund to the couple’s Donor-Advised Fund before December 31st.

Invest the funds conservatively in the Donor-Advised Fund to ensure the principal does not lose value and is there to donate over the next few years.

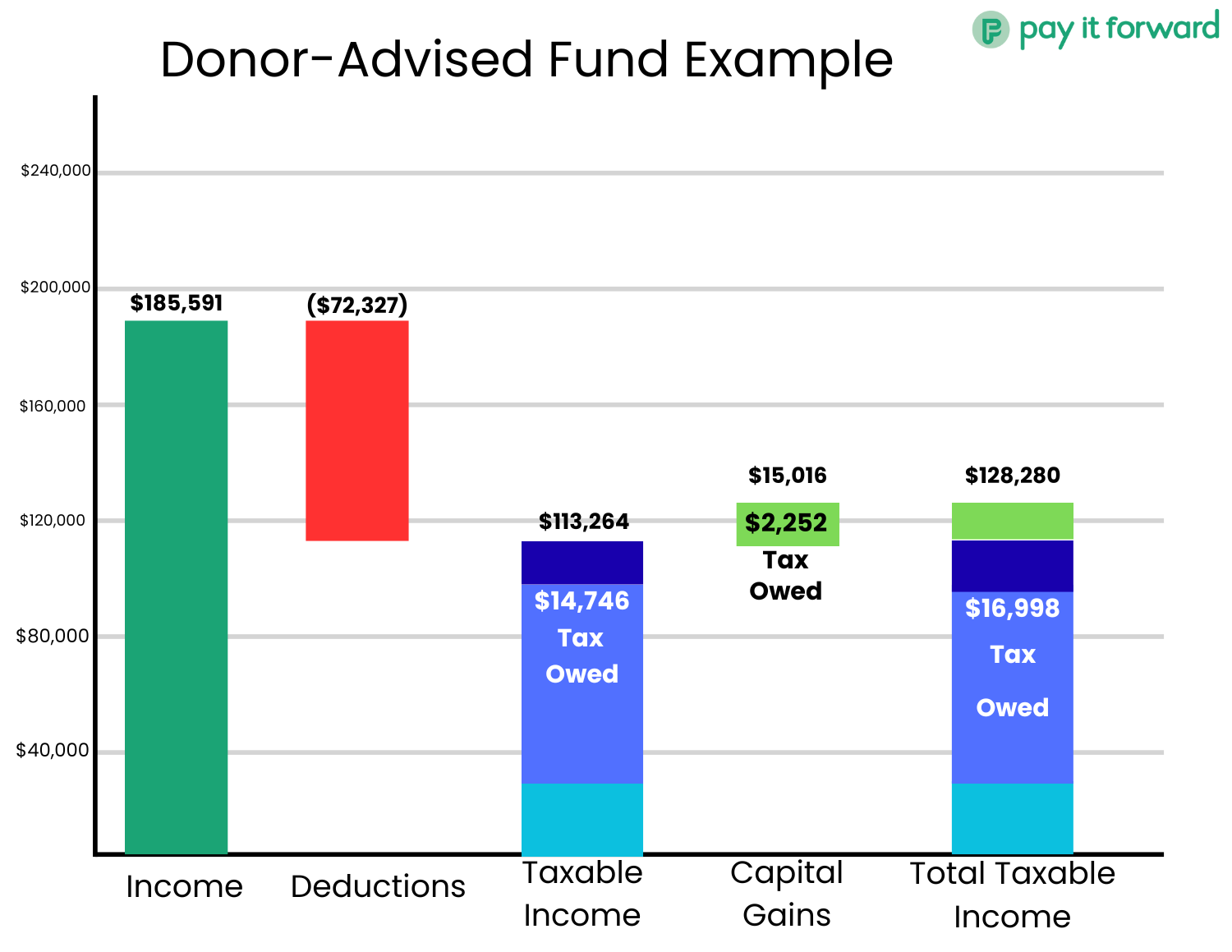

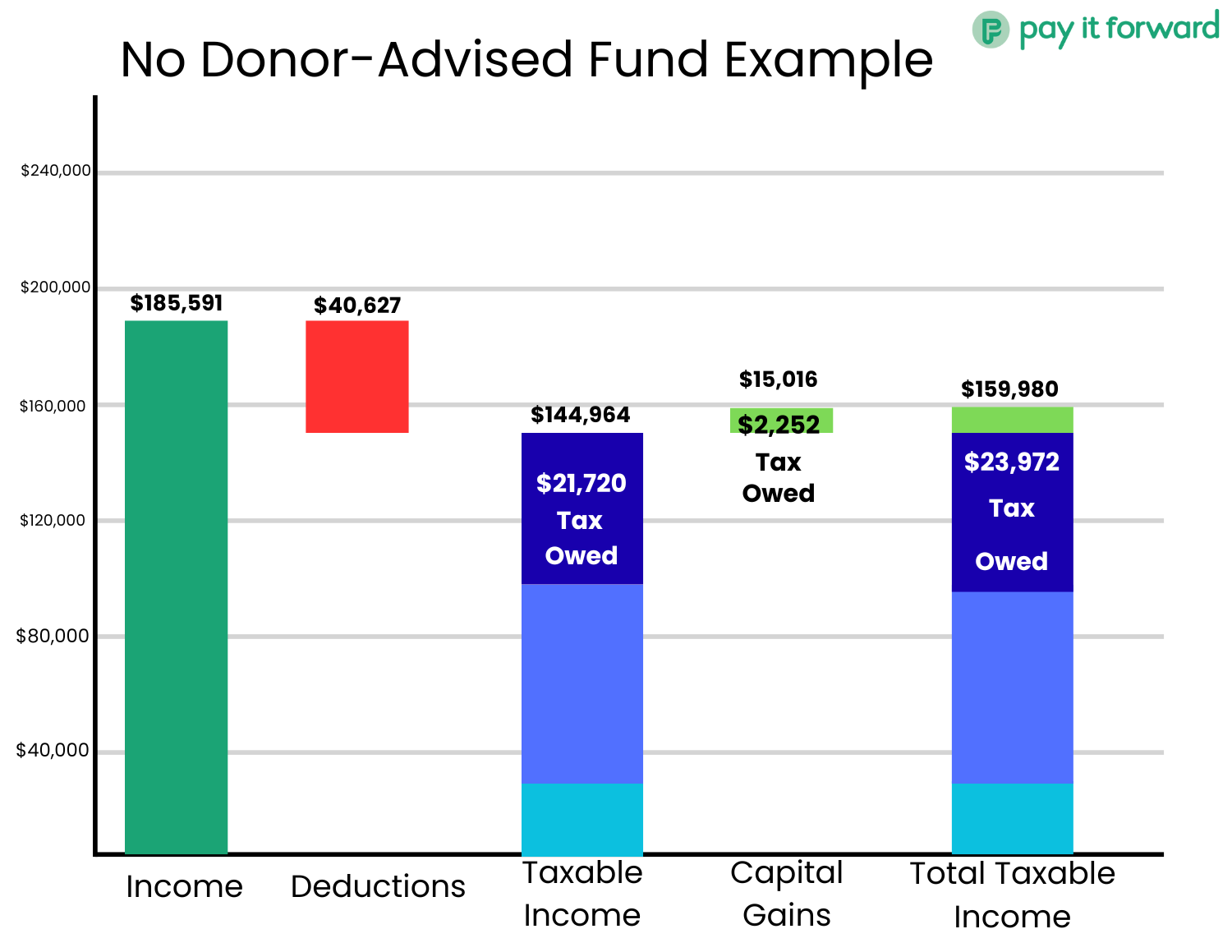

The Tax Impact:

The $60,000 contribution to the Donor-Advised Fund allows this couple to “itemize” their deductions. These itemized deductions significantly reduce the portion of their income that is subject to taxation.

Contrast their tax situation to the hypothetical situation where NO CONTRIBUTION IS MADE TO their donor-advised fund. In that situation, their taxable income is $31,700 larger, causing the couple to owe nearly $7,000 more in federal taxes.

Key Takeaways:

By “chunking” their charitable contributions, the couple gets more “bang for their buck” by increasing their allowable deductions, and, ultimately their taxable income.

Every additional $1 of charitable contribution reduces their federal taxes by $0.22, until they hit the 12% bracket.

The tax deduction occurs when the contribution is made to the donor-advised fund. There is no tax deduction when money is donated from the donor-advised fund to the charity.

frequently asked questions

-

A taxable brokerage account does not have an annual contribution limit.

A 403(b) plan limits your 2026 annual contribution to $24,500. Individuals aged 50 - 59 can contribute an additional $8,000. Individuals ages 60 - 63 can contribute an additional $11,250.

-

YES!

Your 403(b) contribution has no impact on your ability to contribute to a taxable brokerage account.

-

You might consider contributing to a brokerage account if:

Your 403(b) does not offer the ability to contribute on an after-tax (Roth) basis.

You need access to a large amount of money in a few years.

All your investments are held within retirement accounts.

You contribute enough to your 403(b) to obtain the full match from your employer.

parting remarks

As a nonprofit professional, educator, and charitable-minded individual, you have the ability to incorporate a taxable brokerage account within your financial plan. As you’ve learned, taxable brokerage accounts can help you in many different ways, one of which is financial flexibility.

If you have questions about a taxable brokerage account and how it could be a part of your financial plan, then feel free to email me (matthew@payitforwardfp.com) or schedule your initial exploration meeting!