tax preparation for busy professionals and families in ohio

what we hear from our clients

I Spend Too Much Time Preparing My Taxes

Problem: Even with tax software, it takes you hours or days to gather your documents, prepare the return, and ensure it’s accurate.

Our Promise: Enjoy your time with your kids. We spend time analyzing your documents and preparing your return so you can get your nights and weekends back!

I Get Stressed that I Overlooked Something

Problem: There are many tax forms and documents to sift through as a working professional. Often, you aren’t sure if the numbers are correct or if you’ve forgotten to take a deduction or a credit.

Our Promise: We will ensure nothing is overlooked, thereby giving you peace of mind.

I Procrastinate Preparing My Tax Return

Problem: You’re busy balancing your career and your family. Finding the time to complete your tax return is a challenge.

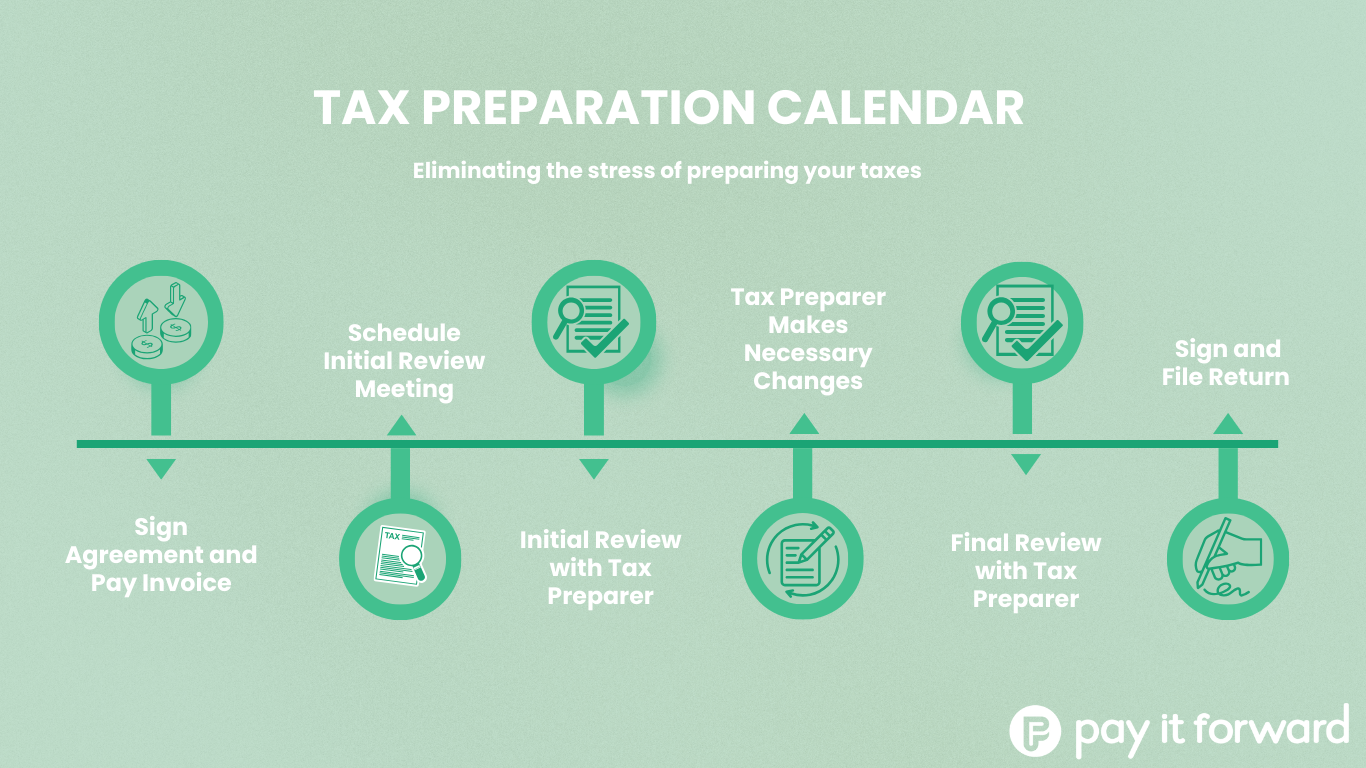

Our Promise: We have a structured timeline that ensures a large percentage of client tax returns are completed by tax day. No last minute rushing!

becoming a client: 2 easy steps

-

Schedule Introductory Meeting

The purpose of this meeting is to dive deeper into your tax situation and to learn more about your tax pain points. Doing so will allow us to determine if we are a good fit for your tax needs. We will also provide you with a proposal that includes the proposed fee for preparing your tax return.

-

Sign Tax Preparation Agreement

Once you’ve reviewed and approved the proposal, we will send you the Tax Preparation Client Agreement.

You are now on your way to a stress-free tax season!

what you’ll receive as a client

-

1:1 meetings

Each tax preparation client is scheduled for two meetings during tax season.

The Initial Review Meeting allows us to ask clarifying questions from the tax documents and information that you submitted. This meeting is designed to eliminate lengthy back-and-forth communication.

The Final Review Meeting gives you the opportunity to ask any tax questions prior to signing your return.

-

tax summary video

A recorded video will accompany the final version of your tax return. The tax summary video will include the following:

1) Key Tax Results - Total income, tax owed or refund amount, and tax rate

2) Highlights & Insights - Notable deductions and credits and other tax “wins”

3) Tips for Next Tax Year - Actionable guidance for the following tax year.

-

secure client portal

No email attachments or mailing documents. We utilize software that allow clients to do the following through their own client login:

1) Secure Document Storage - Upload relevant tax documents within minutes.

2) Sign Your Tax Return

3) View and Pay Your Invoice

Your client portal will ensure that there’s a streamlined and efficient process for preparing, updating, and filing your tax return!

-

Quarterly tax webinars

We provide all tax preparation clients with the opportunity to attend quarterly tax webinars that focus on tax updates and tips relevant to your situation.

Can’t attend the event? No worries! We will send you a link to watch the recorded webinar.

We don’t believe in transactional relationships. Our goal is to provide educational content throughout the year.

our process and pricing

-

Tax preparation services start at $350. We increase the pricing based on the complexities of preparing your tax return, such as owning a rental property or running a business. You will receive your proposed fee prior to signing the Tax Preparation Client Agreement.

We offer two discounts:

20% off of tax preparation fee for ongoing financial planning clients

10% off tax preparation fee for nonprofit employees and educators